🇺🇸 English

Dexi: Decentralized Autonomous Financial Data Network

May 31, 2024

Dexi: Decentralized Autonomous Financial Data Network

Introduction

Dexi is an application on the AO network that autonomously identifies, collects, and aggregates diverse financial data from various events within the AO network. This data spans asset prices, token swaps, liquidity fluctuations, and token asset characteristics like smart contract details. The platform is built on a network of autonomous agents and responsive components. Dexi’s terminal is hosted on the Arweave network, upholding its fully decentralized, permissionless nature.

Dexi caters primarily to two user segments: end-users, who access the platform through the web terminal at dexi.arweave.net, and AO apps, which interact with Dexi by sending messages to leverage the collected data.

A standout feature of the platform is its data subscription service. Processes on the AO network can subscribe to Dexi’s data feeds for a fee, receiving immediate alerts on updates like price adjustments. This feature negates the need for an external oracle, empowering any data-rich app on the AO network to act as an oracle and opening new revenue streams for developers.

Exploring Dexi

In this article, we delve into the current state of Dexi and the functionalities available to users today. Later, we will explore the essential role and potential applications of the real-time data apps on the AO network. Additionally, we will offer concrete implementation examples demonstrating how developers can leverage this pattern in applications building on AO.

Terminal

To start using Dexi, visit the main page available under the ARNS domain dexi. You can access the terminal through various gateways such as dexi.g8way.io or dexi.arweave.net. A comprehensive list of gateaways can be found at ViewBlock Gateways.

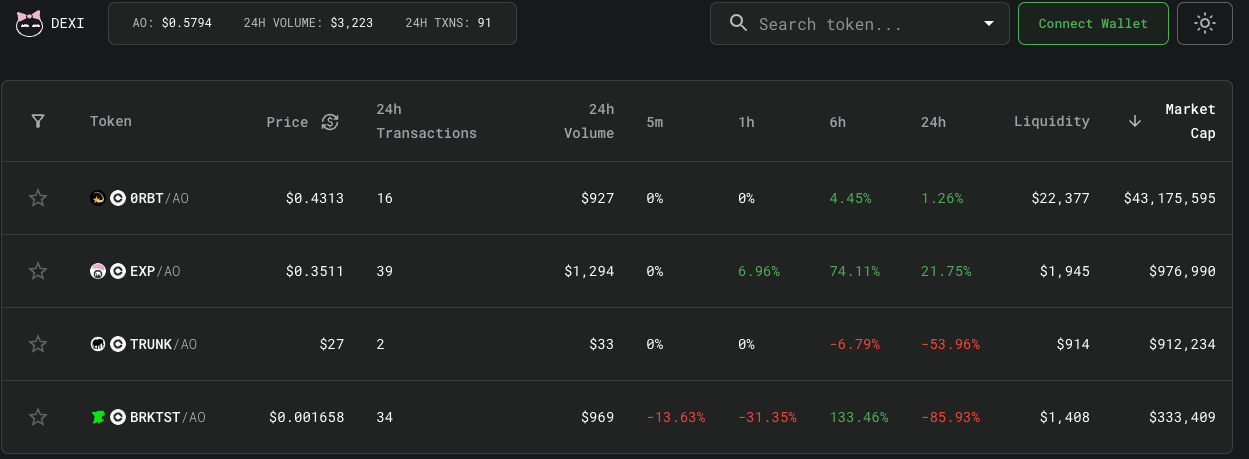

Upon accessing the site, you will encounter the main discovery interface where tradable asset pairs and corresponding data are displayed. Here, you can connect your wallet and add assets to your favorites to create a personalized watchlist.

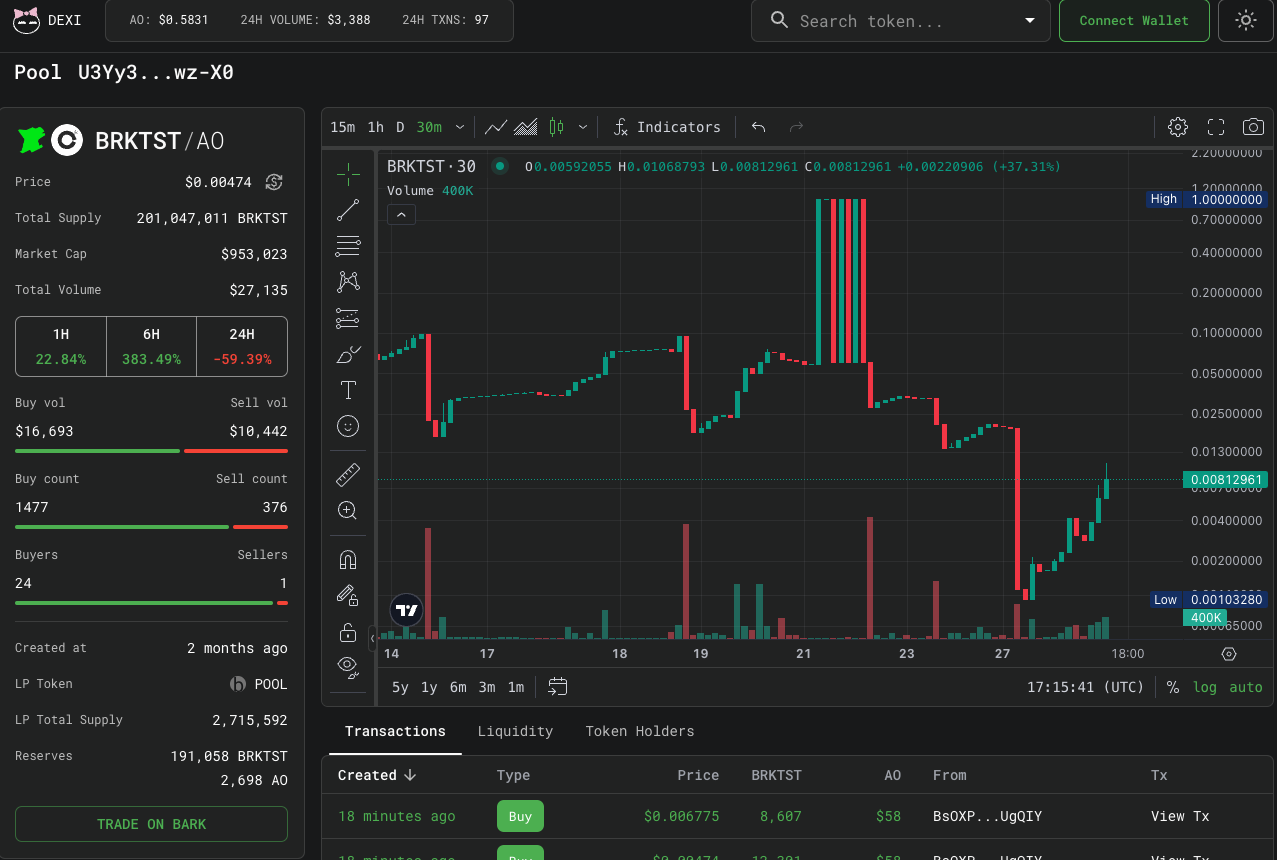

After selecting an asset, you can delve deeper into specific details such as transaction data, price deviations, information about token holders, liquidity pools, LP tokens, total supply, volume, and more.

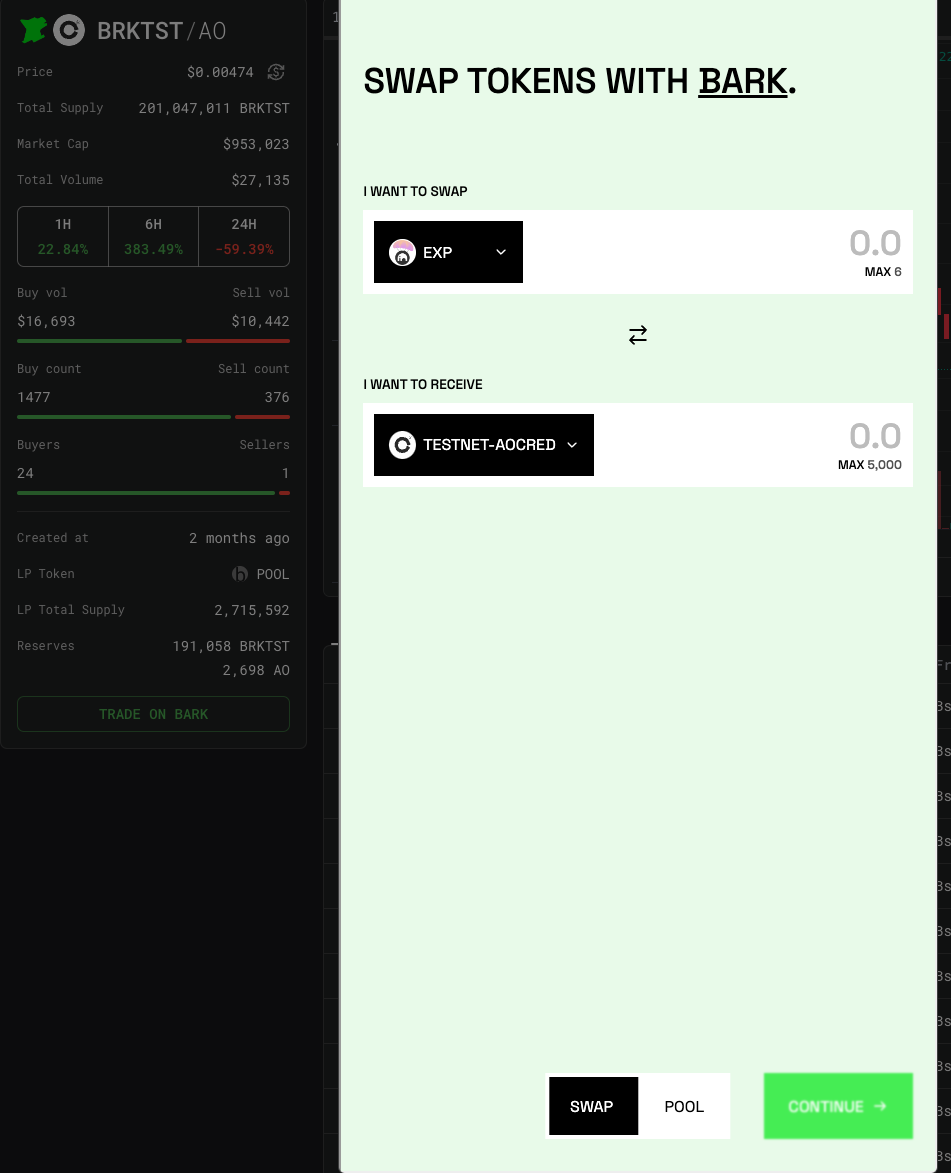

Additionally, Dexi allows for direct execution of swaps from its terminal, using a liquidity pool of your choice.

It's crucial to note that the entire setup is trustless. The terminal runs on Arweave and pulls data directly from the Dexi aggregation agent, making it completely censorship-resistant. All information is verifiable on-chain, safeguarding against manipulation attempts.

Agent Subscription

To subscribe to the Data Agent in Dexi, you need to register your process with the Dexi agent and deposit a fee that will be used to cover the transaction costs. It's important to note that as the current AO Network is in testnet phase, there are no actual transaction costs, allowing developers to freely determine their own cost structure if they wish to apply this pattern. At Dexi, there is a requirement of a minimum of 1 AOCRED per process.

Currently, the Dexi agent network offers two service tiers: free and paid:

Free

- Pull-based access: Users can request data as needed.

- Dry runs (read-only): Allows users to simulate transactions without actual execution.

- Web UI: Accessible terminal for casual browsing and data exploration.

- Basic trading data: Essential data for simple trading analysis.

Paid

- Push-based (subscriptions): Data is automatically delivered based on specified criteria.

- Periodic / Event-based: Updates are sent at regular intervals or triggered by specific events.

Users can register an agent with Dexi by sending the following specific message format, which will add an entry to the subscriptions database:

Send({

Target = 'POJ5oyOzEnQf3Gm7yxVFOmWV5I-LfpAxIw_dYH1Kl-Y',

Action = 'Register-Process',

['AMM-Process-Id'] = 'U3Yy3MQ41urYMvSmzHsaA4hJEDuvIm-TgXvSm-wz-X0',

['Subscriber-Process-Id'] = <Process that should receive Signals>,

['Owner-Id'] = <Subscriber Owner>

})

This structured setup ensures that developers and users can easily engage with Dexi’s services, utilizing the network’s capabilities for both basic and advanced data needs.

Architecture

Role of Dexi in the AO Network

Dexi's data agents facilitate the integration of financial data across various processes within the AO network. These agents are critical for:

- Trading Agents: They provide access to price and liquidity data necessary for formulating risk management strategies.

- Exchanges: They use Dexi as a reliable source for oracle-type price feeds.

- Liquidity Pools and Swaps: They utilize data to adjust their incentive structures dynamically.

- On-chain LLMs: They analyze data to enhance strategic decision-making.

Dexi is an AO-native application that addresses some of the common challenges faced by traditional blockchain systems, such as scalability and processing speed. By enabling advanced data processing tasks directly on the blockchain, Dexi supports the broader functionality of the AO computer. This support is crucial for developing sophisticated financial applications in the AgentFI space.

Implementation

Key Functions of Dexi:

-

Real-Time Data for Web Users: Dexi provides immediate access to financial data and analytics on its website, helping traders and analysts make informed decisions quickly. This is facilitated via read-only dry run transactions.

-

Data Subscription for Automated Agents: Other applications or automated trading bots can subscribe to receive continuous data updates from Dexi, enabling them to respond instantly to market changes.

Unlike conventional blockchains, AO can execute arbitrary WASM code that is deterministic, enhancing scalability by avoiding a shared global state. Dexi capitalizes on this capability using the AOS-SQLite module, a WASM version of the SQLite database, allowing for on-chain database functionalities like aggregations, triggers, and complex queries. Dexi updates its internal state table by receiving proactive messages from AMMs as transactions occur. Specifically, it receives a copy of the Order-Confirmation message sent to users, which is used to update its data. This table undergoes aggregation to convert raw data into familiar trading indicators.

Additionally, a cron process periodically updates key indicators and dispatches them to on-chain financial agents for timely trade execution.

Hands on

At the core of the Dexi application is the transactions table.

CREATE TABLE IF NOT EXISTS amm_transactions (

id TEXT PRIMARY KEY,

source TEXT NOT NULL CHECK (source IN ('gateway', 'message')),

block_height INTEGER NOT NULL,

block_id TEXT,

sender TEXT NOT NULL,

created_at_ts INTEGER,

to_token TEXT NOT NULL,

from_token TEXT NOT NULL,

from_quantity INT NOT NULL,

to_quantity INT NOT NULL,

fee INT INT NULL,

amm_process TEXT NOT NULL

);

It serves as the single source of truth of all charts, metrics and signals. It does not feature any transformations and is as close as possible to the onchain data. Only the source column is added. Keep reading to find out what it refers to.

Syncing

Having accurate data is paramount for Dexi, and it has two ways to achieve this:

The input event

We are consuming a standardised event emitted by the AMM, called Order-Confirmation. This event is emitted on each successful swap. This event maps perfectly to our amm_transactions table.

Pull Based

To backfill historical state Dexi can pull data in via an Oracle such as 0rbit. Dexi will request in an iterative fashion updates and consume these messages until it has caught up with the latest transactions. This works permisionlessly as gateway data is freely available.

Push based

Dexi can also receive and verify messages from the registered AMMs. In that case updates do not suffer the delay from being published via the gateway. This allows for real time updates on the site, however it is opt in and needs to be configured during AMM instantiation.

Validation

To prevent inputting invalid data into the database we leverage SQLite check constraints. A check constraint allows you to implement lightweight input validation on the DB layer. We combine it with application side validation using the Lua Schema validation package.

Constructing charts and metrics

Intermediate View

Once data is persisted in the amm_transactions table we construct a view on top that handles the type conversions and adds a few additional features, such as determining whether the current transaction is a buy or a sell.

CREATE TABLE IF NOT EXISTS amm_registry (

amm_process TEXT PRIMARY KEY,

amm_name TEXT NOT NULL,

amm_token0 TEXT NOT NULL,

amm_token1 TEXT NOT NULL,

amm_discovered_at_ts INTEGER

);

It also combines data from the AMM registry to add in some relevant meta information. You may ask, why not just push this logic into the underlying table? As long as you keep these transformations lightweight enough, using a view here gives you much more flexibility without resorting to complex migrations. Want to add a column? Just swap out the view.

CREATE VIEW amm_transactions_view AS

SELECT

id,

source,

block_height,

block_id,

sender,

created_at_ts,

to_token,

from_token,

from_quantity,

to_quantity,

fee,

amm_process,

CASE WHEN to_token = amm_token1 THEN 1 ELSE 0 END AS is_buy,

ROUND(CASE

WHEN from_quantity > 0 AND to_quantity > 0 THEN

CASE

WHEN to_token = amm_token1 THEN from_quantity * 1.0 / to_quantity

ELSE to_quantity * 1.0 / from_quantity

END

ELSE NULL

END, 12) AS price,

CASE

WHEN to_token = amm_token1 THEN from_quantity

ELSE to_quantity

END AS volume

FROM amm_transactions

LEFT JOIN amm_registry USING (amm_process)

Constructing charts and metrics

Now that you have this view, constructing metrics is very easy. Querying transactions and volume is as easy as this

SELECT

amm_process,

COUNT(*) AS transactions,

SUM(volume) AS volume

FROM amm_transactions_view

WHERE created_at_ts >= :now - 86400

GROUP BY 1

Refer to candles.lua for an example of how to retreive candles from the present data. The Dexi process exposes many of these queries via handlers, you can see them in action on https://dexi.g8way.io/ or find their description in the README.

Dispatching Signals

Having outlined the process of indexing on-chain data, structuring it, and constructing signals, let's now turn our focus to dispatching these signals.

Payment Model

Dexi's payment model demonstrates the AO network's flexibility. Read-only offchain requests are handled by a subsidized CU, serving non-commercial users who browse information for potential purchases. These nodes can be locally operated, allowing anyone to verify results independently.

For onchain financial agents who require enhanced economic security due to immediate actions based on Dexi's signals, the model differs. Trigger dispatches operate on the AO mainnet, secured by its full economic safeguards. This service incurs gas costs, which are covered by a subscription fee. Financial agent operators select the signals they need, and are provided with an estimate of the gas expenses plus Dexi fees for a specified period. Once the payment is completed, the owner registers their bots with Dexi to periodically receive the necessary data.

Funding

Before Dexi can dispatch messages, users must fund their accounts for the specific process they are utilizing. Currently, a minimum balance of 1 AOCRED is required to begin receiving messages. Funds are added on a per-user basis and can be allocated across multiple processes.

Funds tracking is managed using a SQLite balances table, detailed as follows:

function sqlschema.updateBalance(ownerId, tokenId, amount, isCredit)

local stmt = db:prepare[[

INSERT INTO balances (owner, token_id, balance)

VALUES (:owner_id, :token_id, :amount)

ON CONFLICT(owner) DO UPDATE SET

balance = CASE

WHEN :is_credit THEN balances.balance + :amount

ELSE balances.balance - :amount

END

WHERE balances.token_id = :token_id;

]]

if not stmt then

error("Failed to prepare SQL statement for updating balance: " .. db:errmsg())

end

stmt:bind_names({

owner_id = ownerId,

token_id = tokenId,

amount = math.abs(amount), -- Ensure amount is positive

is_credit = isCredit

})

local result, err = stmt:step()

stmt:finalize()

if err then

error("Error updating balance: " .. db:errmsg())

end

end

Constructing Indicators

Constructing indicators involves straightforward steps. First, extract data from SQLite, then aggregate this data at your chosen frequency, and finally apply custom Lua logic to compute the desired indicators. For practical examples of how to calculate common indicators using Lua, see the indicators.lua script.

The Cron

Dexi operates on a cron schedule, receiving a tick every minute. However, it currently sends signals hourly by evaluating the cron message's timestamp to determine the start of a new hour. At each new hour, the following steps are executed:

- It iterates through all registered AMMs.

- It verifies all subscribers are funded.

- It computes the indicators.

- It dispatches the messages.

local ammsStmt = db:prepare([[

SELECT amm_process, amm_discovered_at_ts

FROM amm_registry

]])

if not ammsStmt then

error("Err: " .. db:errmsg())

end

local oneWeekAgo = now - (7 * 24 * 60 * 60)

for row in ammsStmt:nrows() do

local ammProcessId = row.amm_process

local discoveredAt = row.amm_discovered_at_ts

local startTimestamp = math.max(discoveredAt, oneWeekAgo)

indicators.dispatchIndicatorsMessage(ammProcessId, startTimestamp, now)

end

ammsStmt:finalize()

print('Dispatched indicators for all AMMs')

The subscribing agent will now receive hourly messages with the action IndicatorsUpdate, carrying a data payload of indicators tagged with the source AMM. The data field contains an array of indicator objects, each covering a retrospective of 7 days. Below is an example of how to decode and access an indicator update:

indicatorUpdate = json.decode(msg)

>indicatorUpdate[1]

{

date = "2024-04-16",

sma200 = 10,

sma100 = 10,

open = 10,

sma50 = 10,

sma150 = 10,

volume = 220,

close = 10,

low = 6.666666666667,

high = 10,

sma20 = 10,

sma10 = 10

}

It can then implement bespoke trading logic, eg detecting a golden cross

local todaysIndicatorUpdate = indicatorUpdate[1]

function detectGoldenCross(indicatorUpdate)

local goldenCross = false

if indicatorUpdate.sma50 > indicatorUpdate.sma200 then

goldenCross = true

end

return goldenCross

end

detectGoldenCross(todaysIndicatorUpdate)

Building & Deploying

Although AOS includes a built-in loader that can resolve modules, we prefer using Lua Amalg. This approach generates a single amalgamation file that can be efficiently evaluated in one step using AOconnect. We complement this with aoform, a streamlined utility for deploying AO processes. You can explore it on our Github.

Deployment (build.sh):

/opt/homebrew/bin/luacheck process.lua schemas.lua sqlschema.lua intervals.lua candles.lua stats.lua validation.lua indicators.lua

/opt/homebrew/bin/amalg.lua -s process.lua -o build/output.lua sqlschema intervals schemas validation candles stats indicators

npx aoform apply

Based on our testing, amalgamations currently perform more reliably than the aos loader and offer the convenience of deploying with a single command.

Conclusion

Autonomous Data Agents are pivotal to the evolution of the new Web. Where once oracles and external applications using Gluecode were essential to deploying autonomous agent models for decentralized applications, today's Data Agents bridge the gap. They enable the creation of fully autonomous, data-intensive applications that meet the demands for high-speed data processing.

Dexi is a prime example of this shift. As a decentralized agent network, it utilizes Autonomous Data Agents and Reactive Components, capitalizing on the AO blockchain's unique capabilities to incorporate SQLite. This integration allows for sophisticated on-chain data analysis and real-time decision-making within DeFi scenarios, addressing common efficiency and scalability challenges in blockchain applications and pioneering new methods for data management and interaction.

As the blockchain and DeFi landscapes continue to advance, Dexi's role becomes increasingly crucial. It is poised to significantly influence the future of financial transactions and strategic implementations across AO. Ongoing enhancements and adaptations will keep Dexi as an essential tool for builders, traders and financial analysts, driving the AgentFi domain in exciting, innovative directions.